Open card link:https://hornetpay.uk/#/signup?referer=VIRTUALCARDX&lang=zh-CN

At a time of increasing demand for cross-border online shopping and overseas platform subscriptions, a good virtual credit card can solve a lot of payment challenges - such as the inability to bind domestic bank cards in some regions, and the fear of leaking physical card information. I recently experienced HornetPay (official website:https://hornetpay.uk ) This virtual credit card platform, from the point of view of ordinary users to do some tests, today will be objective talk about its actual performance.

First things first: what are the core HornetPay card types? Who is it suitable for?

Open the platform home page, the most intuitive is the three types of virtual cards, each positioning is very clear, I first organized the key information, so that we can be convenient to the right place:

- Hong Kong Card: $1 card opening fee, recharge rate 2%, supported platforms, Facebook, PayPal, Shopify, Tiktok, Alibaba, AliExpress, maximum daily spending limit: $100k;

- Singapore Card: $2 card opening fee, recharge rate 2%, supported platforms, Facebook, PayPal, Shopify, Tiktok, Alibaba, AliExpress, maximum daily spending limit: $100k;

- American Card: $2 card opening fee, recharge rate 2%, supported platforms, Facebook, PayPal, Shopify, Tiktok, Alibaba, AliExpress, maximum daily spending limit: $100k.

It is worth mentioning that the three types of cards are labeled “no KYC”, the actual test of opening the card does not have to submit ID cards, passports and other identity materials, enter the basic information within 1 minute to get the virtual card card number, CVV code, for those who want to use the card quickly is very friendly.

User Tests: what's it really like to open a card, pay for it, and pay for it?

I've tested 3 key aspects of the “normal user's card process” to try to recreate the real experience:

- Card opening efficiency: No KYC is really fast, but pay attention to the expiration date!

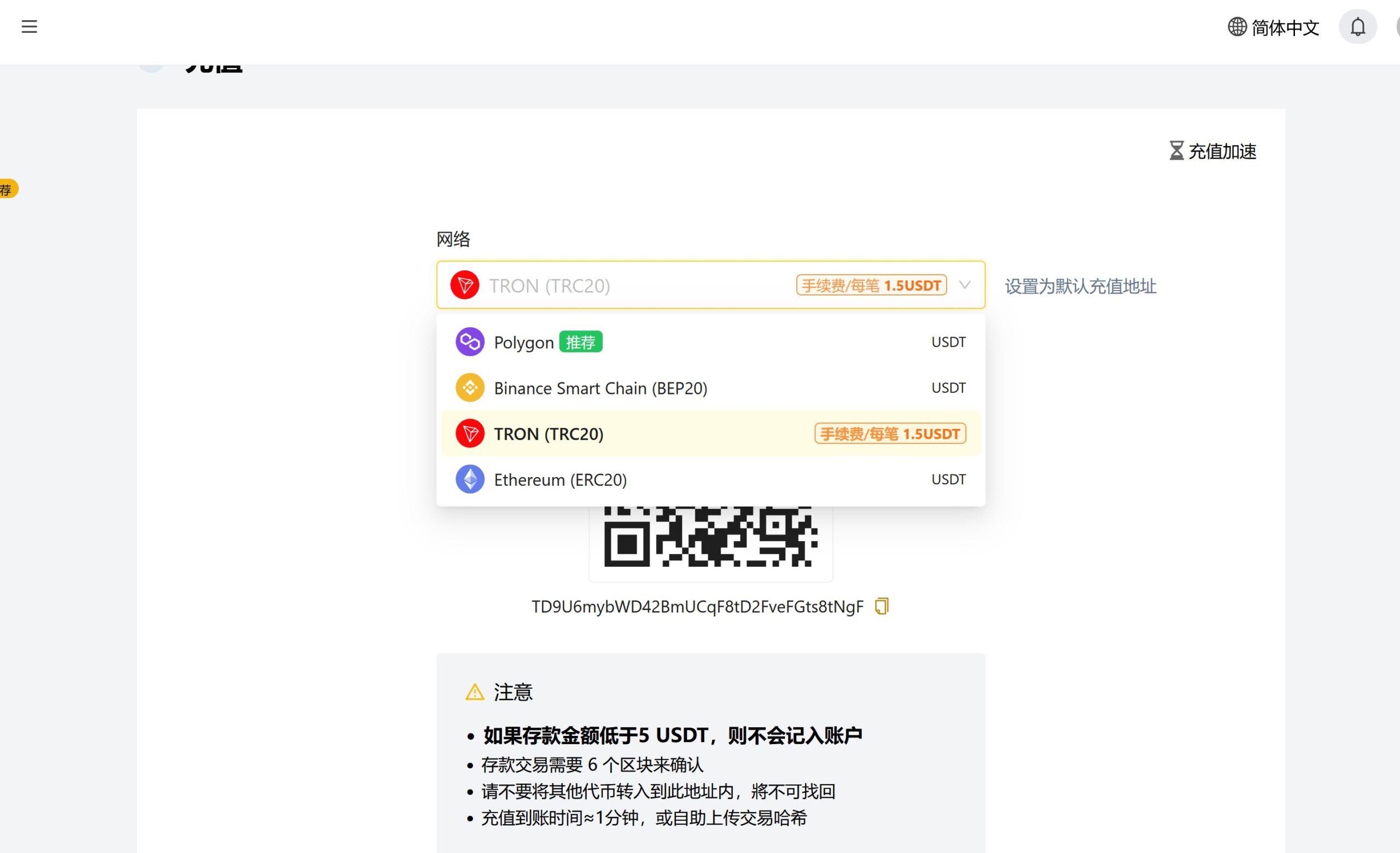

No need to fill out identity information, select the card type, recharge and then get the card information, this point is more flexible than many need to audit 1-3 days of the platform. But remember, the card is valid for 35 months, after the expiration date, you need to re-apply, it is recommended to note the validity of the card after opening, to avoid the break in the middle of the use. - Recharge Method: USDT, support for TRX, POL, ETH, CoinSmart Chain

Neutral says: clear advantages, but there are also points to watch out for

Something to be recognized::

First, “KYC-free” lowers the threshold of card use, especially suitable for users who do not want to disclose their identity information; second, multiple BINs (e.g., 8 BINs for Platinum and Trial cards, and 12 BINs for Universal cards) can reduce the probability of being rejected by platforms due to card segmentation; third, the supported scenarios cover most of the cross-border online needs, from daily shopping to professional subscriptions, all of which can be accommodated. Most of the cross-border online needs, from daily shopping to professional subscription can be taken into account.

Details to look out for::

Although the platform mentioned the “security of funds”, but the virtual payment itself does not have the physical card loss protection, once the card number is leaked, the risk is higher than the physical card.

A final word of caution: use it, but don't “over-trust” it.”

From the test results, HornetPay has good convenience and adaptability in cross-border online payment and specific subscription scenarios, which is especially suitable for users who have temporary overseas payment needs and don't want to go through the complicated KYC process.

However, as a user, I would also like to make a small suggestion: do not completely reject the platform, but do not treat it as a “long-term depository”. It is recommended to recharge the card according to the needs of each use, for example, if you want to subscribe to ChatGPT for $20 per month, you should recharge more than $20 (counting the deposit fee and possible inter-region commission), and recharge as much as possible, so as to avoid keeping a large amount of money in the account and to minimize the potential risk of funds. After all, for virtual payments, it's safer to “top up carefully and use up in a timely manner”.