At a time when cross-border consumption is becoming more and more frequent, many people have encountered such embarrassment: Netflix's new show is online but can't pay the fee, ChatGPT Plus subscription is dissuaded by the payment link, Steam promotion misses the discounts, and niche nautical nautical official website only recognizes Visa/Mastercard ...... Data shows that over 70% of cross-border consumption failure stems from incompatible payment methods. The Roogoo virtual card, which has attracted a lot of attention recently, has become a popular alternative to the Bybit card by virtue of its ”0 rate”, ”multi-scene support”, ”domestic availability” and other highlights. This article combines real test experience and information from various sources to dismantle this cross-border payment tool from core advantages, application process, usage scenarios to risk tips.

Exclusive no card opening fee account opening link:https://h5.roogoo.store/register?inviteCode=dhbbgm

I. Core Advantage: Why Roogoo can become the ”King of Sea Leveling”?

1. KYC friendly, no threshold for domestic users

Compared with the complex real-name authentication process of some international virtual cards, Roogoo is particularly friendly to domestic users: it supports ID cards, passports, driver's licenses and other documents for authentication, and recommends the use of the Sumsub channel, which is operated online in a few minutes, without the need to run around in offline outlets. Whether you are a cross-border e-commerce practitioner, a student or a digital nomad, you can easily pass the authentication, solving the pain point of the traditional international card, ”difficult to open an account for domestic users”.

2. Transparent costs, limited time 0-cost access

This is one of the most attractive features of Roogoo, which is the ”king of price/performance ratio” compared to traditional international cards:

| Type of fee | Traditional International Card | Roogoo Virtual Card (limited time benefit) |

|---|---|---|

| opening fee | 50-200 dollars | 0 dollars |

| Recharge Fee | 1-3% | 1% (transaction fees) |

| Cross-border transaction fees | 1.5% | 1.6% |

| Currency Conversion Fee | 2-3% | Real-time exchange rate, 0 markup |

| Annual/monthly fee | Universal charging | not have |

The limited time benefit policy is slightly adjusted with the stage: now you can lock in 0 opening fee + 0 rate trial within 7 days of signing up to open a card, and subsequently if you want to continue to enjoy 0 rate for life, you can realize it by pledging the platform's native ROOG tokens. For users who spend $1,000 per month across borders, the annual handling fee of traditional cards exceeds $300, while Roogoo can realize full savings.

3. Flexibility in top-ups, without funds being tied up

Roogoo supports the USDT recharge of TRON (TRC20) and SOLANA, with 1USDT≈1USD, the minimum recharge amount is only 10USDT, and it is expected to arrive at the account within 2 minutes, which really realizes ”recharge as you go”. Users do not need to occupy a large amount of funds for a long time, spend as much as you want to charge as much as you want, which not only reduces the idle cost of funds, but also enjoys the USDT call earnings (yesterday's APY amounted to 4.02%), which takes into account the convenience of payment and profitability.

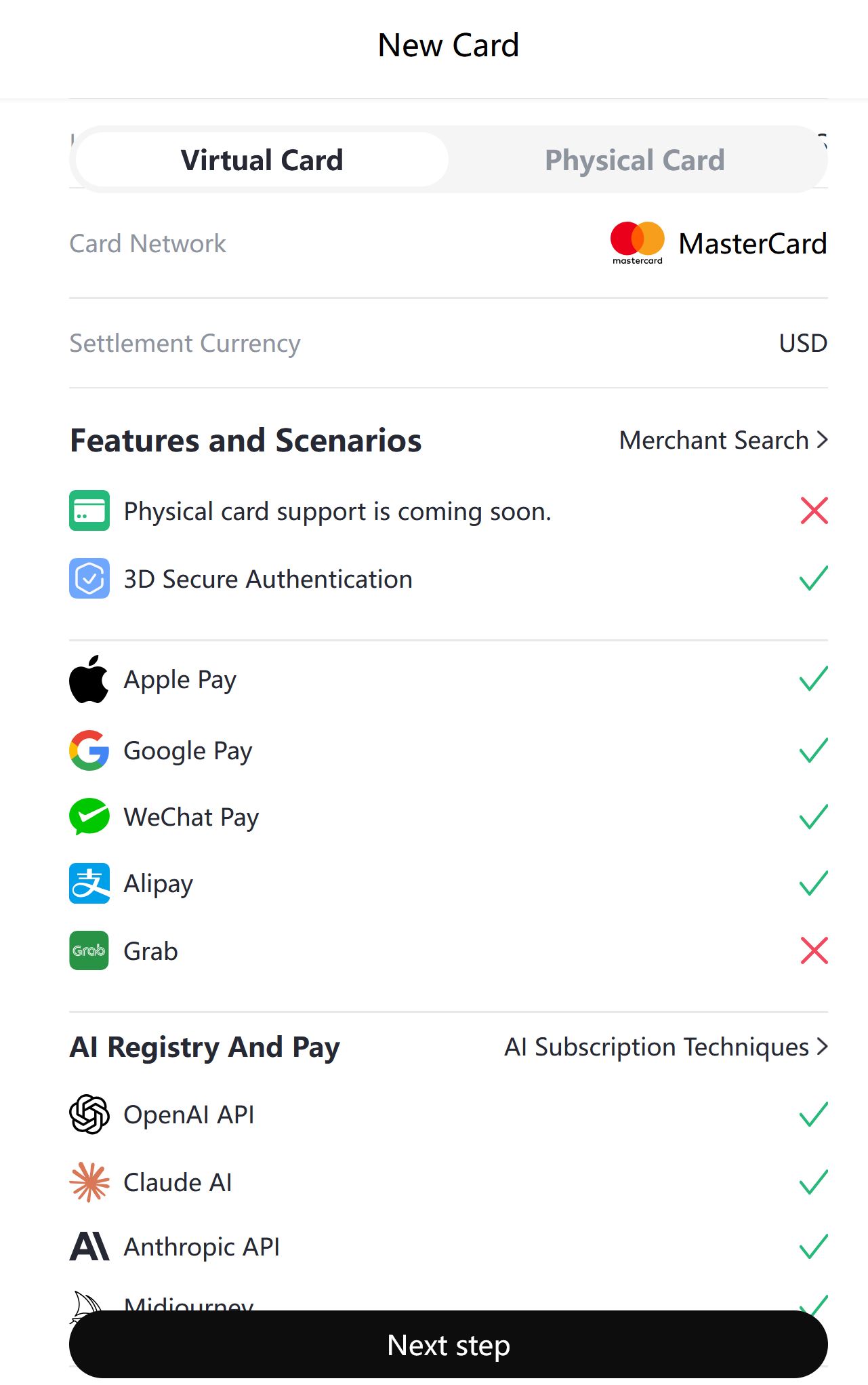

4. Full coverage of payment scenarios, both domestic and international can be used

Roogoo's scenario support is ”all-inclusive” and breaks down payment barriers completely:

- Domestic Payment: Perfectly bound to WeChat Pay, Alipay, Meituan, Jingdong, daily consumption without pressure;

- International Payment: Compatible with Apple Pay, Google Pay and other mainstream international wallets, overseas offline merchants can also be used;

- Subscription services: ChatGPT Plus, Spotify, Netflix, Telegram, Twitter and other platforms subscribe to one-click payment, previously not supported by the domestic card AI tools (OpenAI API, Claude AI, Midjourney) can be smoothly settled;

- E-commerce shopping: Amazon, TEMU, Steam and other cross-border e-commerce and gaming platforms to pay directly, nautical and game purchases without hindrance.

Actual test experience: after charging 10USDT and binding Roogoo card to buy Cyberpunk 2077, the payment is second without extra handling fee, comparing with the substitute platform to save 15% difference; subscribe to ChatGPT Plus for $20 per month, stable use of GPT-4, no need to rely on third-party unstable services, work efficiency is obviously improved.

5. Compliance, security and long-term availability

Roogoo holds a U.S. FinCEN MSB license (No. 31000260355089), which is a compliant licensed payment tool. User funds are segregated, not included in the platform's operating pool, KYC data encrypted storage in line with GDPR standards, privacy and capital security is more secure, avoiding the risk of some niche virtual cards ”suddenly stop serving”.

Second, the application and card-opening process: 10 minutes to get it done, even a white man can get started!

Roogoo's application process is extremely simple, with a full online operation and no complicated documents required:

- Click on the exclusive invitation link (https://h5.roogoo.store/register?inviteCode=dhbbgm), register with your email address and receive a verification code;

- Completion of KYC certification: upload photos of ID/passport and other documents, Sumsub channel audit is the fastest, a few minutes to pass;

- Choose a card type: virtual card available instantly, open by October 15 to apply for a physical card (free shipping), supports MasterCard or VISA organizations;

- First time recharge: minimum 10USDT (20USDT is recommended to avoid commission issues), via TRC20 or SOL chain transfer;

- Activate the card: you can activate it after the recharge arrives and enjoy the cashback benefits (1U-2U + ROOG airdrop qualification for the first card in some channels).

The whole process from submission to card opening takes only 10 minutes and requires no specialized knowledge, so it can be easily completed by novice users.

Third, welfare activities: multiple rewards, open the card to earn

Roogoo has a large current benefit and is extremely cost effective when stacked:

- Limited Time 0 Opening Fee + 0 Rate: you can lock in this benefit within 7 days of opening the card, and subsequently pledge ROOG to upgrade to 0 rate for life;

- Cashback on card opening: Sign up via exclusive invitation link and get 1U-2U back upon activation (varies slightly from channel to channel);

- Airdrop Qualification: You can get ROOG token airdrop qualification after the first charge;

- Invitation Gift: Successfully invite your friends to open a card, each of them will get $1 cashback, and the promotion benefits can be upgraded.

IV. Notes and Risks

- Blacklist Restriction: Some platforms may not support Roogoo payment, it is recommended to check whether the target platform is in the support list before use;

- Amount and wind control: the first recharge is recommended to be no more than 100 U.S. dollars for testing, to avoid frequent large transactions to trigger the wind control;

- Compliance use: It is necessary to comply with the local foreign exchange management regulations, and is strictly prohibited to be used for money laundering and other illegal activities, otherwise it may lead to account freezing;

- Service stability: At present, ChatGPT payment function is not supported by some users, and the platform promises to be fully open after accessing the U.S. card at the end of the month;

- Cashback and activities: the welfare policy is time-sensitive, cashback amount, airdrop eligibility, etc. are subject to the latest official rules, it is recommended to confirm the details of the activities before opening the card.

V. Summary: Who is suitable to get the Roogoo virtual card?

With the advantages of KYC friendliness, fee transparency, comprehensive scenarios, compliance and security, Roogoo virtual card has become a high-quality choice for cross-border payment, which is especially suitable for the following people:

- Cross-border e-commerce practitioners, foreign trade B2C merchants: need flexible and convenient cross-border collection and payment tools;

- Students, digital nomads: often subscribe to overseas streaming media, AI tools, or spend on seafood and games;

- Former Bybit card users: affected by restrictions on domestic use, need for alternative programs;

- Cryptocurrency Users: Holders of USDT who wish to conveniently realize ”Coin to Card Spending”.

As an infini alternative, Roogoo does not recommend heavy investment, and it is more prudent to follow the principle of ”spend as much as you can”. The current time-limited 0-fee benefit is extremely cost-effective, and for users with cross-border payment needs, it is worthwhile to take advantage of the activity period to get started and lock in long-term preferential interests.

Overall, Roogoo virtual card solves the core pain points of traditional cross-border payment, such as high cost, difficult authentication and narrow scene, and becomes a popular choice for cross-border payment with the combination of ”0 cost + full scene + compliance”. As long as the rules of use are complied with and risk control is done well, it can really bring great convenience to global consumption and realize the freedom of payment of ”one card to go all over the world”.