As a foreign trade practitioner, cross-border payment has always been a pain point in the business chain - high fees, cumbersome audit, inconvenient multi-currency switching, and even customer loss due to payment failure. Recently, I tried a virtual credit card platform called 4399Pay, and was impressed by its ultra-low fees and efficient service, so I'd like to share my actual experience with it.

As a foreign trade practitioner, cross-border payment has always been an inextricable pain point in the business chain - high handling fees, cumbersome auditing, inconvenient multi-currency switching, and even customer loss due to payment failure. Recently, we have tried a program called4399PayI am impressed by the low rates and efficient service of the virtual credit card platform, and would like to share my actual experience of using it.

One sentence summarizes the characteristics of 4399Pay: you can only use USDT to recharge, very strict risk control (there is a rejection rate requirements), very low fees (total combined fees of 3%)

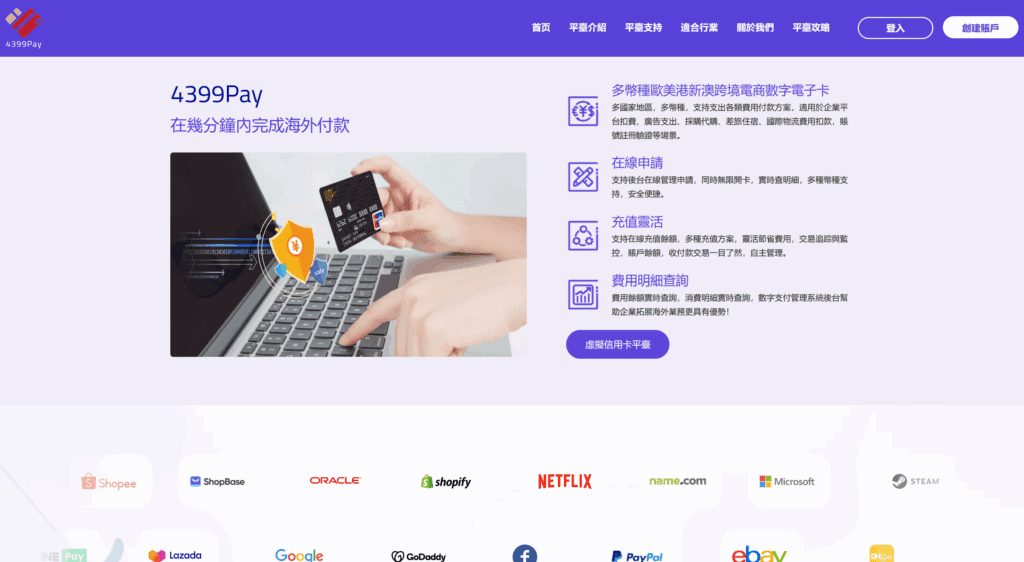

4399Pay's core strengths

- Multi-currency support, covering mainstream scenarios

The platform provides multi-currency virtual cards in Europe, America, Hong Kong, New Zealand and Australia, supporting cross-border e-commerce deduction, advertising (e.g. Google, Facebook), international logistics, travel and accommodation and other scenarios. Especially for the rent and advertising fee payment of Amazon, Sizzler and other platforms, there is no need for frequent exchange of foreign exchange, directly settled in the target currency, saving exchange rate losses. - Transparent tariffs and controllable costs

Compared with similar platforms, 4399Pay's recharge program is flexible and makes no mention of complicated monthly or annual fees. The backend can track spending details in real time, avoiding the problem of invisible handling fees of traditional credit cards. For small and medium-sized foreign trade enterprises, it is especially crucial that every cent of cost needs to be carefully calculated. - Easy card opening and efficient management

The online application is ready to use and supports unlimited card opening. I have opened multiple card numbers for different projects at the same time, which are used for vendor payments and advertisement fee deductions, so that the flow of funds can be seen at a glance, and the efficiency of reconciliation can be improved significantly.

Practical application in foreign trade business

- Ad Placement: In the past, paying for Facebook ads through an agent had a handling fee as high as 5%, while 4399Pay's direct binding debit has a nearly negligible handling fee.

- Seafaring purchases: Some overseas platforms have strict risk control on non-local credit cards, and the chopping rate is significantly lower after using 4399Pay's virtual card.

- Emergency payments: When encountering a customer's temporary additional orders need to advance logistics fees, the second to open a new card to recharge, to avoid delays in the public accounts process.

Suggestions and Precautions for Use

- Microtesting: For first time use, it is recommended to top up a small amount first to confirm whether the target platform supports MasterCard (4399Pay is a partner platform of MasterCard).

- Risk Control Avoidance: Some platforms (e.g. ChatGPT) will check the consistency of IP and billing address, so it is recommended to use it with a pure IP.

- Rate Comparison: Comprehensive rate of 3%, measured against WildCard (recharge fee of 3.5%) and DuPay (can't open cards in bulk), 4399Pay's comprehensive cost is lower, especially suitable for high-frequency micropayments.

summarize

4399Pay is not omnipotent, but its tariff advantage and scene adaptability do provide cost-effective payment solutions for foreign traders. Especially in the current context of exchange rate fluctuations and intensified cross-border competition, reducing payment costs indirectly improves profit margins. If you are trapped in the traditional credit card cumbersome and high rates, may wish to include it in the list of options.