June 2025 Update: Sadly, this card has been retired!

https://app.infini.money/signup

Recently, the Infini Virtual MasterCard U Card has been discussed more and more in the circle of cross-border payment and virtual card usage. As a user who often needs to buy and subscribe to overseas services, I signed up to try it out and experience it, and today I'm here to talk to you about my real feelings, and give a reference to those who want to get one.

I. Registration process: simple and direct, a few steps to get it done

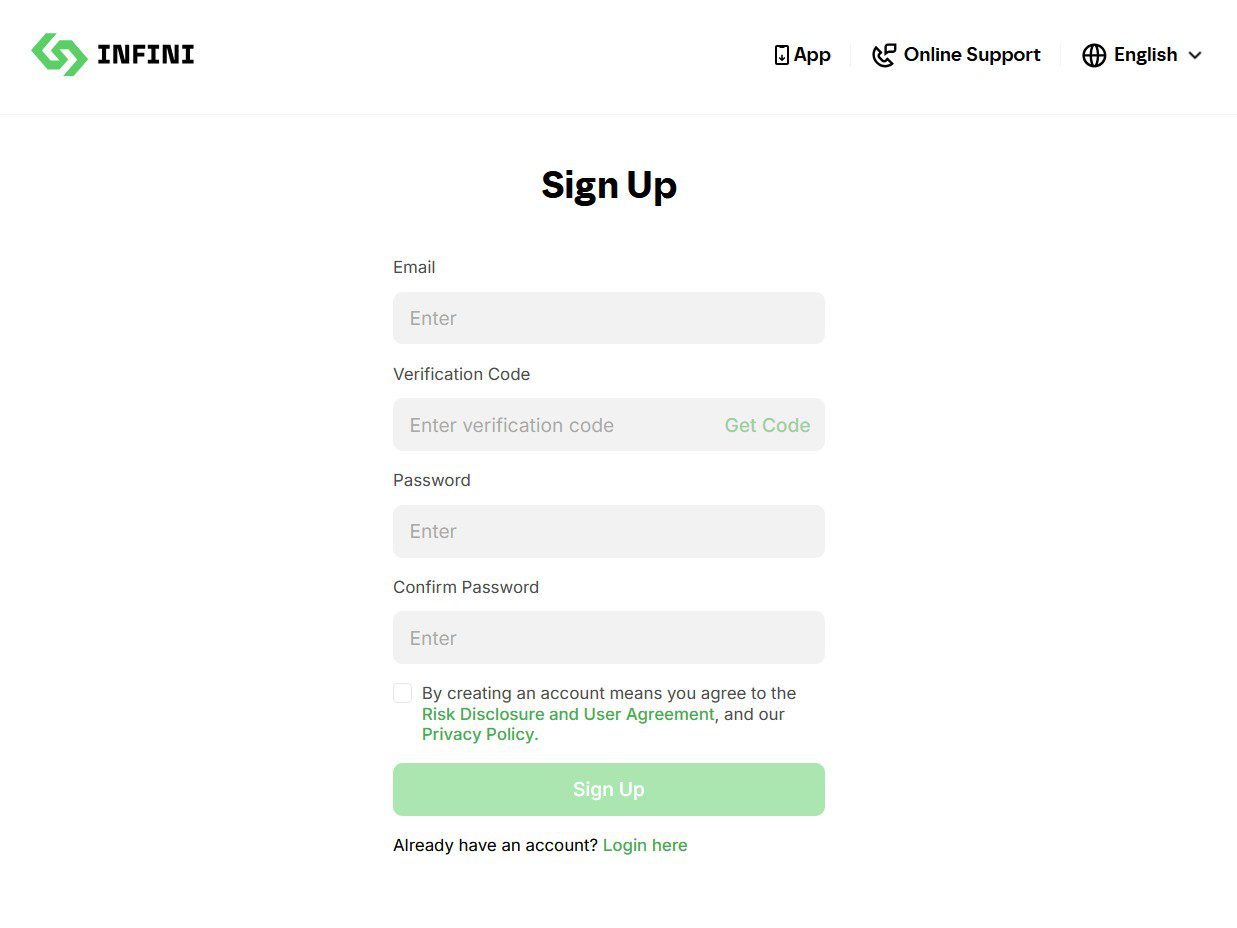

Let's start with the registration process, which is after all the first step in using any service.Infini's registration portal is very clear and opens directly to the official website link (https://app.infini.money/signup) will be able to see the simple registration interface. There are no complicated steps in the whole process, and the information you need to fill in, including email, verification code, and setting a password, are all mandatory basics with no extra redundancies, making it friendly to newbies.

After filling out the information submitted, the system response speed is quite fast, almost seconds to complete the registration, there is no lag or wait a long time. The whole process down, about 5 minutes can be done, than I have used some of the virtual card platform registration process to be a lot smoother, there is no cumbersome identity verification of the front link, this point must be praised.

Second, the card function: covering common scenarios, high flexibility

After registering, you can soon see your virtual card information in the background.Infini Virtual MasterCard U Card is a MasterCard that supports mainstream currencies such as the US dollar, which means it can cover most of the common cross-border payment scenarios. For example, I often use this card to pay for my Amazon purchases, Netflix subscriptions, and overseas game cards, so it's a good card to use.

The management function of the card is also relatively complete. In the background, you can view the transaction records at any time, and every expenditure is clear, so it is convenient to reconcile and manage your spending. In addition, you can also set spending limits as needed, such as single-day spending limit, single transaction limit, etc. This flexibility is very practical for users who are worried about the safety of their funds, which is equivalent to putting a "safety lock" on their spending.

Third, the use of experience: smooth payment, handling fee transparency

In actual use, the most intuitive feeling is the high degree of payment smoothness. Whether it is online shopping or in-app subscription, as long as the place that supports MasterCard, basically the payment can be completed in seconds, and there has not been any payment failure or long waiting time. Moreover, the exchange rate display during the transaction is very clear, and the exchange rate and handling fee of the current transaction will be informed in advance, there is no hidden fee, which is very reassuring.

In terms of handling fees, compared to similar products, Infini's fees are relatively transparent and reasonable. Different types of transaction fees are slightly different, such as cross-border consumption, cash withdrawal, etc., but there are clear instructions on the official website and in the background, which will not give people the feeling of "being pitched". For users who often have the need to make small cross-border payments, such a fee model is still acceptable.

Fourth, safety and security: multiple measures, with peace of mind

For virtual cards, security is definitely a top priority, and Infini has done a pretty good job in this regard. First of all, registration and login require an email verification code, which already adds a layer of security protection. Secondly, some sensitive information is hidden when the card is displayed in the background to avoid accidental leakage. In addition, the previously mentioned spending limit setting is also part of the security protection, which can effectively prevent the occurrence of theft and other situations.

Although I didn't experience the speed at which customer service handles urgent issues, the information on the official website indicates that they have a dedicated customer service team that provides 24-hour online support, so problems encountered should be resolved in a timely manner. However, I hope to never use this part of the service, after all, security and stability is the most important.

V. Summarizing: Who is it for?

After experiencing the Infini Virtual MasterCard U Card, my overall impression is that it is moderate but not lacking in highlights and is suitable for the following categories of users:

- nautical enthusiast: Often shopping on overseas e-commerce platforms requires a convenient cross-border payment instrument.

- Overseas service subscribers: Things like subscription streaming platforms, cloud services, etc. require stable payment methods.

- novice user: Not very familiar with virtual card operation, would like to have simple and easy to understand registration and use process.

Of course, it is not perfect. For example, the currencies supported by Infini are mainly in US dollars, and there may not be enough support for other niche currencies; in addition, the arrival time of the withdrawal function is a little slower than that of some platforms. But all in all, if you need a practical, safe and easy to use virtual MasterCard, Infini is still worth a try.