In the process of conducting cross-border business, the smoothness of the payment link is crucial. With its convenience and flexibility, virtual credit card has become the choice of many foreign trade and cross-border practitioners. Recently contacted hlcard virtual card platform, in the actual use of the show some noteworthy features, the following from a number of dimensions for you to introduce.

Official website address:https://hlcard.net/

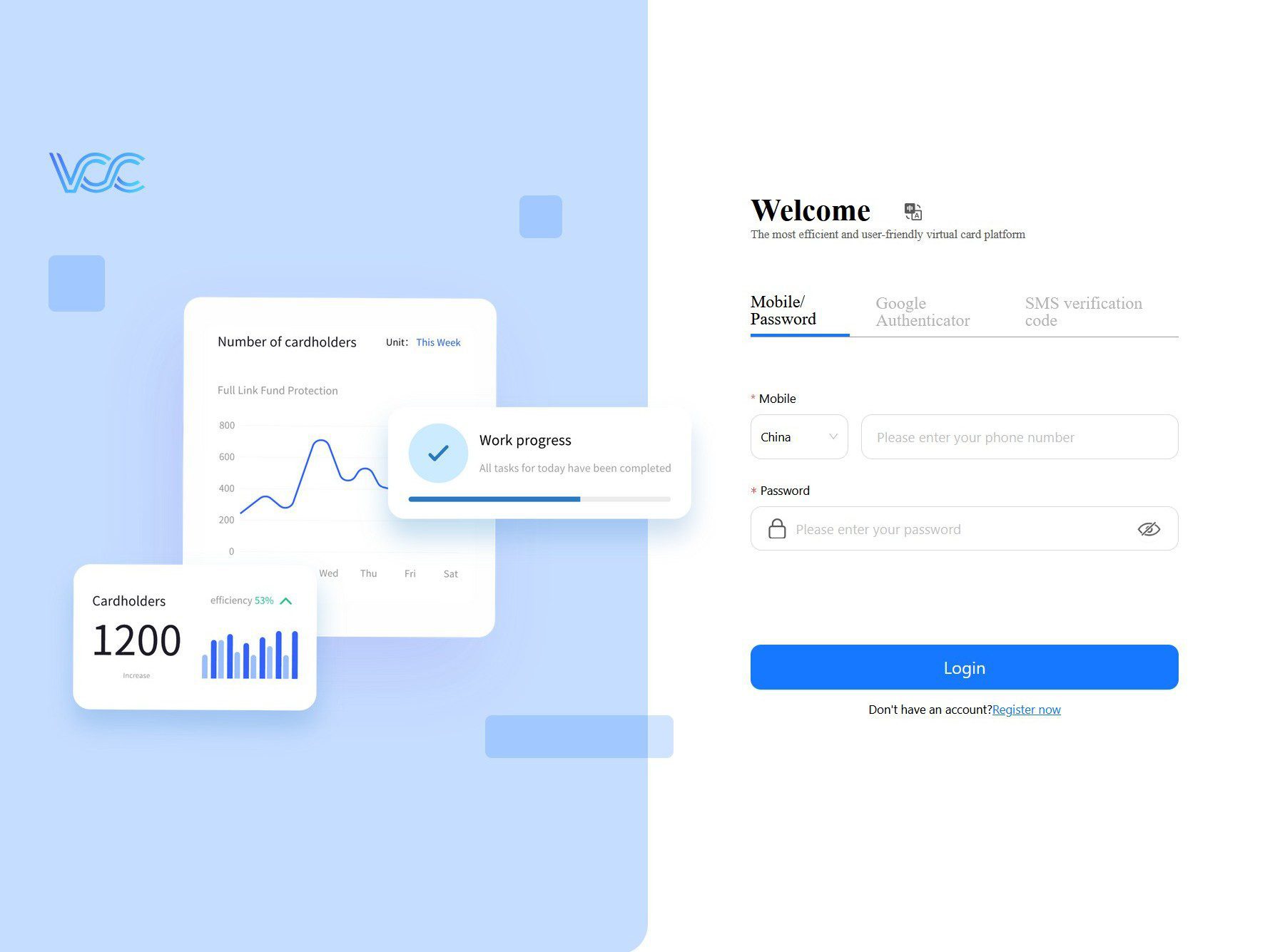

I. Registration and Certification Process

The platform currently uses an invitation system to register, you need to contact the channel manager to get a one-time registration link. Registration needs to meet three conditions: first, Chinese residents, need to complete the face real-name authentication; second is to provide mainland China cell phone number, used to pick up the code verification (disposable number can not be used, and environmental changes or a long period of time without logging in need to be re-validated); third is to fill in a valid mailbox, in order to receive the platform notification. Although the overall process needs to contact the channel in advance, the authentication process is relatively convenient with the help of Alipay's face recognition system, and the audit efficiency is high.

II. Card segment resources and applicable scenarios

The platform has docked a wealth of card segment resources, covering Hong Kong and the United States, there are currently 28 card segments, and will be dynamically updated according to market demand. Currently, there are 28 card segments, which will be dynamically updated according to the market demand. Among them, the Hong Kong card segments include 493193, 438357, etc.; the U.S. card segments such as 486695, 559292, etc. These card segments are applicable to a wide range of cross-border business scenarios, and can be used for store rent payment on Amazon, Shopify and other platforms, nautical shopping, advertising and marketing (e.g., Facebook, Google Ads), hosting and domain name purchase (e.g., Godaddy, AWS), and overseas phone card top-up (e.g., Ultra Mobile PayGo, Google Voice) and other scenarios. Voice) and other scenarios. However, it should be noted that some scenarios have specific restrictions on card segments, for example, ChatGPT may not support card segments issued in China and Hong Kong, so users need to test their choices in light of their actual needs.

III. Cost structure

The platform's cost components are clear and consist of the following:

- opening fee: $2 per sheet.

- Recharge FeeThe handling fee for Alipay/WeChat transfer top-up is 2%; Alipay online top-up and USDT online top-up (closed) require an additional 1%, and the actual handling fee is 3%.

- Card Recharge Service Fee:: 2%.

- Failed Payment Handling Fee: A stepped rate is in effect, with a handling fee of $0.15 + 1% failed amount for rejections below 15%, and $0.5 + 1% failed amount for rejections above 15%, with additional fees for some card segments.

- Low Spending Handling Fee: The minimum spending amount varies by card segment, and transactions below the low spend are charged per transaction, e.g., $0.6/transaction for transactions below $50 for the 491724 segment, and $0.15/transaction for transactions below $10 for most of the other card segments.

- Cross-border Handling Fee: No cross-border fee for some card segments (e.g. 556167, 493193, etc.), the rest of the card segments are charged $0.5 + 1% transaction amount.

Operation experience and function highlights

The process of creating a card is simple. After the recharge reaches the account, you can quickly open a card by selecting a card segment and entering the amount in the card management interface, and 16 card segments are opened by default, with an unlimited number of cards to be opened. The platform has added a new application scenario query function, which allows users to input the target scenario (e.g. "ChatGPT") and refer to the card segments used by other users before opening a card, thus improving the efficiency of card segment selection. The card management interface allows users to clearly view the card number, expiration date, security code and other information, which facilitates transaction management.

V. Precautions

The platform explicitly restricts "three high" users with high refusal, high refund and high verification, and restricts the use of some scenarios (e.g., Steam, AWS, Wechat, etc.), so users need to confirm in advance whether their business is in line with the platform's rules. In addition, payment failure may be caused by insufficient balance, network environment (such as proxy IP is restricted), banks to close the MCC code and other factors, we recommend that users ensure that the card balance is sufficient, choose a compliant network environment, and pay attention to the platform announcement to understand the card segment dynamics.

Overall, hlcard platform has certain advantages in terms of richness of card segments, diversity of applicable scenarios and ease of operation, and the fee structure is transparent but the cost of some scenarios needs to be evaluated comprehensively. For foreign trade and cross-border practitioners, they can choose to use hlcard according to their own business needs, combined with the rules and restrictions of the platform.

HL Dragon, a virtual card, is relatively niche but still relatively solid