This card is the one seen so far that is built entirely on a self-hosted wallet and is extremely easy to open

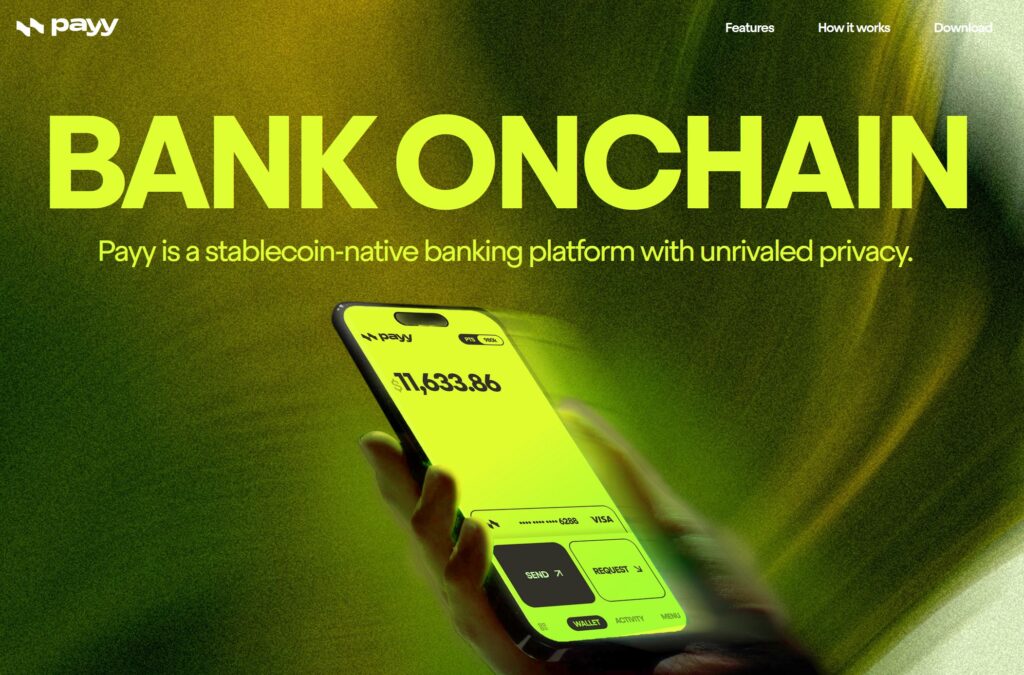

Platform homepage: payy.link

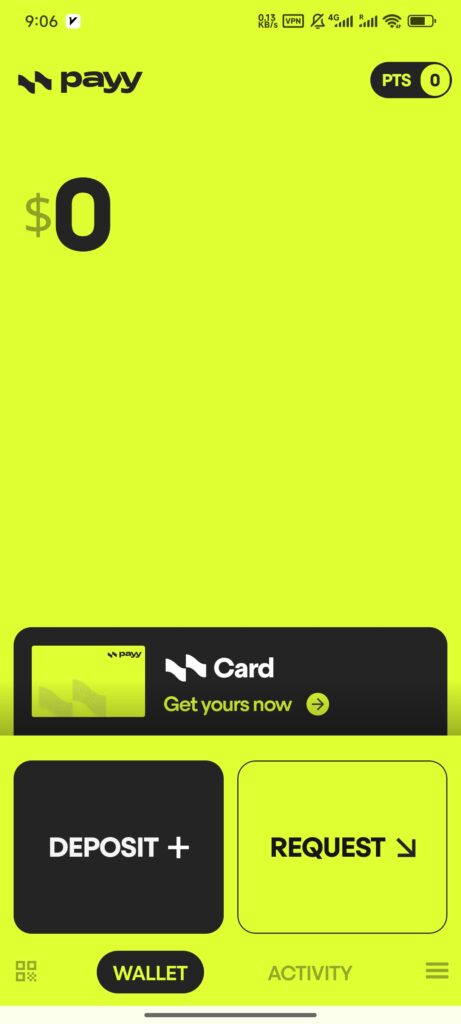

I. Main interface of the platform

The main interface of the Payy platform App is designed with distinctive features and a clear layout of the core functional modules, which makes it easy for users to operate quickly, and mainly contains the following key areas:

- Functional entrance areaThe core functions of “Get your card”, “WALLET”, “Card”, etc. are provided in the prominent position, and users can directly click on the buttons to enter the corresponding operation pages. button, users can directly click to enter the corresponding operation page.

- Points & Rewards Area: The “Rewards” option takes you to the points page, which displays the user's current points balance (e.g., newcomers receive 10,000 points for entering an invitation code), the rules for earning points (e.g., invite 1 person to apply for the card and receive 10,000 points, 1 point per day for each dollar spent), and the entry point for redeeming points (100,000 points can be exchanged for a (100,000 points can be redeemed for a physical card).

- Menu & Personal CenterThe menu can be expanded by pressing the “MENU” button in the upper left or lower right corner, including “Enter friend's code”, “ACTIVITY”, “Deposit”, “Withdraw”, etc. It supports users to complete the functions from registration to use. ACTIVITY" (transaction records), "Deposit" (recharge), "Withdraw" (withdraw) and other functions, to support the user to complete the whole process of operation from registration to use.

II. Timing of the establishment of the platform

January 2024

III. Card opening fees

Based on the consistent descriptions in the 3 documents, the Payy Virtual U CardNo card issuance feeIn addition, no credit check is involved in the application process. Users can complete the application and opening of the virtual card free of charge, and only need to complete the identity authentication according to the process to use it, without additional initial costs.

IV. Top-up rates (consolidated)

Payy platform top-up related rates are transparent, there is no top-up fee, only in the consumption part of the currency conversion fee, as follows:

- top-up rateGoogle Pay is supported, as well as the ability to add coins to wallets (multi-chain compatible, such as the Polygon main chain), both of which are free of charge, and users can transfer funds to their wallets/cards free of charge.

- consumer rate: Purchases made with the Payy Virtual Card are only charged forCurrency Conversion Fee for 1%No other hidden fees (e.g., annual fee, account management fee, withdrawal fee, and other unmentioned extra charges), and overall cost is low.

V. Snap Heads (Applicable Scenarios)

1. Card head information

The card BIN (header) of the Payy Virtual U Card is454924It is a Puerto Rico Dollar Card issued by Rain, Inc. and is a VISA card that supports U.S. dollar billing.

2. Applicable scenarios

- online payment: It can be bundled with Google Pay and Apple Pay, and supports VISA payment scenarios on various online platforms (e.g. shopping, subscription, bill payment, etc.).

- offline consumption: After bundling Mobile Pay, you can swipe your card at offline merchants (e.g. convenience stores, restaurants, supermarkets, etc.) that support Google Pay/Apple Pay.

- Future Expansion Scenarios: The official clearly stated that “bank transfers will be supported soon”, the follow-up can further cover the demand for inter-bank fund transfers, the use of the scene will be more extensive.

VI. KYC requirements

The KYC process for Payy Virtual U Card is minimal and provides a user-friendly experience for domestic users with the following requirements:

- No materials required: Proof of address (e.g., utility bill, bank current) is not required, and face recognition is not necessary, avoiding the tedious steps of traditional KYC.

- Materials to be submitted: Only basic personal information and documentation is required, including:

- Personal information: real date of birth, email address (for receiving notifications), Hong Kong cell phone number (for verification, the document suggests using a Hong Kong cell phone number such as giff).

- Documents: Chinese nationality users need to choose “Nationality: China”, submit ID card, passport or driver's license (recommended ID card / passport, higher pass rate), truthfully fill in the document number, upload the document photo (such as passports only need to take a photo of the front side, “reverse side ” can take a page at random to pass the audit).

- Audit efficiencyMost of the users can “pass” the audit in seconds without waiting for a long time after submitting the correct materials according to the tutorial.

VII. Whether you need a cell phone number to register

Requires a cell phone number to registerand explicitly requires the use ofHong Kong Cell Phone Number(The document repeatedly mentioned “cell phone number should be filled in Hong Kong's cell phone number”, recommended that users without a Hong Kong cell phone number to use giff and other Hong Kong cell phone number services), for account verification and subsequent login / operation notification, does not support the registration of mainland China's cell phone number.

VIII. Top-up method

Payy supports two mainstream top-up methods, covering different user needs, the specific operation is as follows:

- Google Pay RechargeEnter the App “Deposit” page, select the “Google Pay” recharge channel, follow the instructions to complete the binding and payment, the funds will be transferred directly to the wallet / card, no handling fees.

- Wallet Play Coin RechargeWallet supports multiple chains (e.g. Polygon main chain, compatible with other chains), users can transfer corresponding coins (e.g. U) to Payy wallet address via external wallet, which can be used to spend on cards after arrival, with no reload fee.

IX. Availability of physical cards

Physical card available, which users can obtain by redeeming points:

- Conditions for redemptionFree physical card redemption with 100,000 points, which can be earned by “Entering an invitation code (10,000 points for newcomers)” “Inviting others to apply for the card (10,000 points for each invitee)” and “Daily spending (1 point per day for USD 1)”. Daily spending (1 point per day for every dollar spent)" and so on.

- Physical Card Features: It is presumed that the physical card has the same function as the virtual card, and supports binding mobile payment or offline card swiping, and the specific use scenarios can be referred to the virtual card (subject to the official follow-up instructions).

X. Characteristic highlights

Excellent UI design and smooth experience: The App has a beautiful interface and clear functional layout, and the whole process from application to use is “silky smooth”, which reduces the threshold of user operation and enhances the daily use experience.

True “self-hosted” assets, high securityUnlike most virtual card platforms, Payy supports the extraction of wallet private key directly from the App, the assets belong to the user, controlled by the user, no third-party custodian risk, the private key / mnemonic backup to protect the security of the assets (the document has repeatedly emphasized the importance of “backing up the mnemonic”, the loss of which can not be recovered).

KYC is minimalist and domestic user friendlyKYC system: Self-built KYC system, no address proof, face recognition, only simple documents and materials, high audit efficiency, to solve the traditional virtual card KYC cumbersome, low pass rate of domestic users of the pain points.

Transparent and low-costNo card opening fee, no recharge fee, only 1% currency conversion fee, no hidden cost, suitable for high-frequency and small consumption users.

Multi-scenario compatibility and flexible useVISA card attributes support binding Google Pay/Apple Pay, online and offline coverage; wallet multi-chain compatibility, flexible recharge methods, the future will also support bank transfers, the scene of strong scalability.