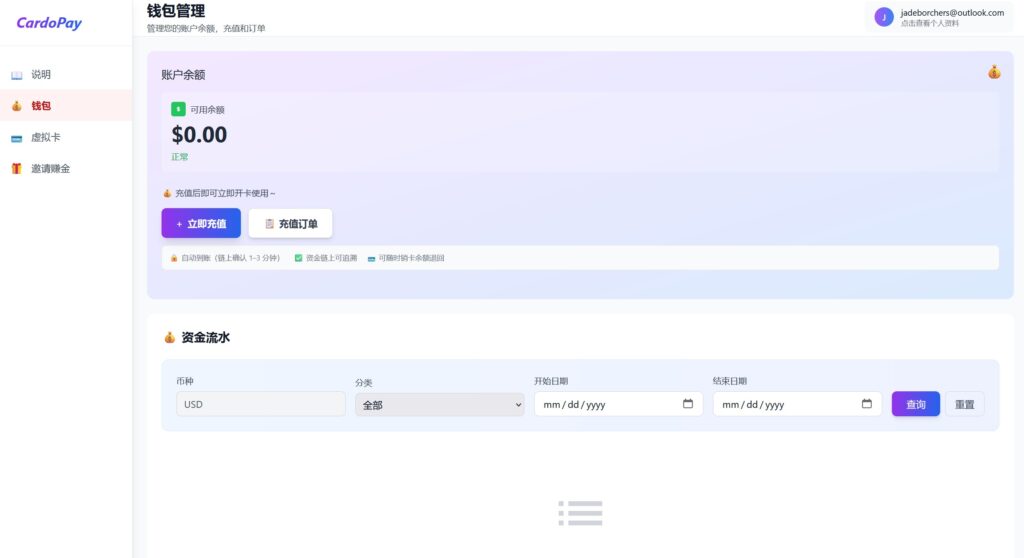

Platform homepage:https://cardopay.app

I. Main interface of the platform

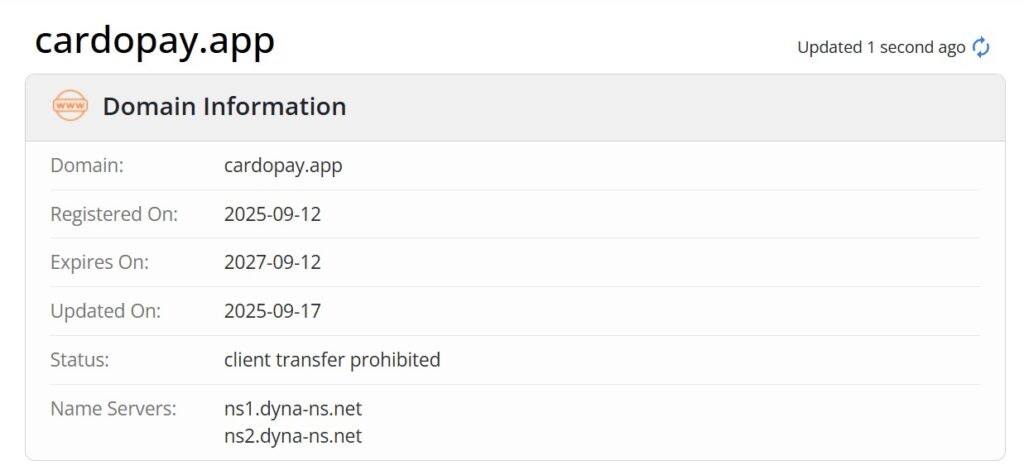

II. When the platform was established

No earlier than September 2025

III. Card opening fees

10$-20$ (cards supporting niche scenarios)

IV. Top-up rates (consolidated)

Recharge rate 2%

V. Snap Heads (Applicable Scenarios)

CardoPay virtual cards are categorized into different scenarios, covering a wide range of mainstream consumption and service scenarios, as follows:

- AI subscription services: Support ChatGPT, Claude, Midjourney and other global AI services subscription, taking into account the need for privacy protection;

- Cross-border e-commerce and shopping: Adapt Amazon, eBay, Shopify, Walmart and other cross-border e-commerce platforms to protect the security of bank card information;

- Travel Spending: Can be used for hotel booking, flight booking and shared ride service spending on Airbnb, Booking, Agoda and other platforms, and supports one-time virtual card usage;

- Digital Entertainment: Subscription services and digital entertainment consumption covering Steam, PlayStation, Xbox, Epic Games and other gaming platforms;

- Social Ads: for advertising and social media promotion on Facebook, Google Ads, TikTok, Twitter (X) and other platforms;

- Universal Scenarios: Adapt to Google, TikTok, Netflix, Spotify and other universal payment scenarios to meet diversified consumption needs;

- Adult Social & Niche Platforms: Subscription service for websites that support OnlyFans and various niche platforms.

VI. KYC requirements

not have

VII. Whether you need a cell phone number to register

not have

VIII. Top-up method

USDT

IX. Availability of physical cards

not have

X. Characteristic highlights

- Comprehensive Scenario Coverage: 7 core usage scenarios are subdivided to accurately match the diversified needs of AI subscription, cross-border shopping, travel and consumption, digital entertainment, etc., adapting to mainstream platforms and niche service scenarios;

- Privacy security guarantee: clearly marked virtual card can protect card information and financial privacy, travel consumption scenarios support disposable virtual card to further reduce the risk of information leakage;

- Convenient card opening process: It takes only 4 steps to open a card, which is estimated to take 1-2 minutes, making the operation simple and efficient, and lowering the threshold for users to use the card;

- Perfect consulting services: Each scene is equipped with an exclusive consulting portal, responding to user selection queries in a timely manner to enhance the experience;

- Supports USDT top-up: Adapts to the needs of virtual currency top-up, providing a convenient option for users who have USDT payment habits.