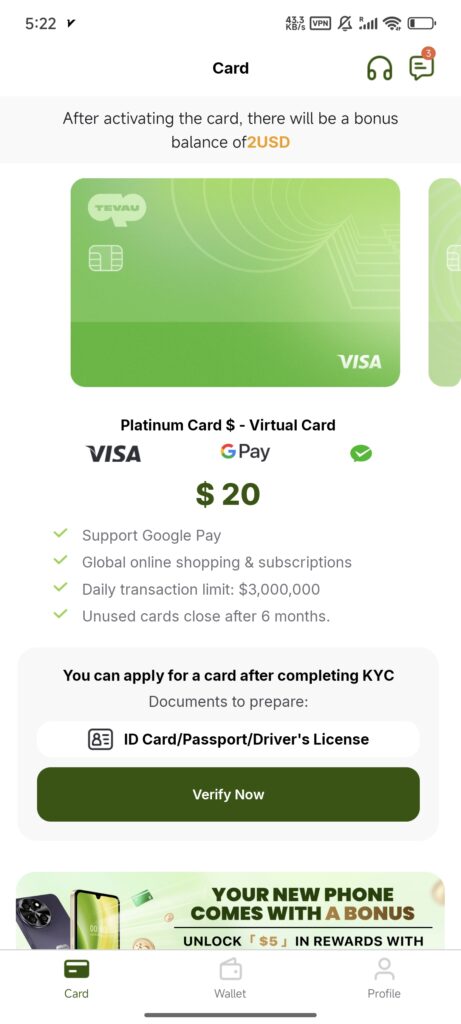

I. Main interface of the platform

II. Timing of the establishment of the platform

No earlier than June 2024

III. Card opening fees

Tevau offers both virtual and physical cards from Visa and MasterCard, with a flat opening fee for each type of card, as follows:

| Card Type | opening fee |

|---|---|

| Visa Virtual Card | 20 USDT |

| Visa physical cards | 100 USDT |

| MasterCard Virtual Card | 20 USDT |

| MasterCard physical card | 100 USDT |

| All cards have no annual fees, reducing the cost of long-term use for users. |

IV. Top-up rates (consolidated)

- Wallet top-ups: no fees, no extra charges for users to top-up their Tevau wallets.

- Card top-up: The handling fee is uniformly charged at the rate of 1%, i.e., when users top-up USDT from their wallets to their cards, they need to pay 1% of the top-up amount (e.g., for a top-up of 1,000 USDT, the handling fee is 10 USDT).

- Additional fees: For non-local currency transactions, a fee of 1.2% is charged for Visa series cards and 2.5% for MasterCard series cards; ATM cash withdrawal fee of 1.9% for Visa physical cards and 2€ per transaction for MasterCard physical cards.

V. Snap Heads (Applicable Scenarios)

(i) Visa Series Cards (Currency: USD)

- Virtual card: full coverage of online consumption scenarios, supporting binding Apple Pay, Google Pay, Alipay, WeChat, PayPal and other mainstream payment platforms, can be used for subscription to ChatGPT, Youtube, Netflix and other services, purchase of cloud servers, online shopping, etc.; single spending limit of $150,000, monthly spending limit of $1 million.

- Entity Card: Supports offline merchant card spending (such as dining, shopping, transportation, etc.) and global ATM cash withdrawal, which can meet the needs of studying abroad, travel spending, daily offline payment, etc.; single spending limit of US$150,000, monthly spending limit of US$1 million.

(ii) MasterCard series cards (currency: euro)

- Virtual Card: Supports Google Pay, applicable to online Eurozone consumption scenarios (e.g. subscription services, cross-border online purchases, etc.); single spending limit of 7,500 euros, monthly spending limit of 50,000 euros.

- Physical card: supports offline merchant spending and ATM cash withdrawal in the euro zone, suitable for euro zone travel, daily consumption and other scenarios; single consumption limit of 7,500 euros, monthly consumption limit of 50,000 euros.

VI. KYC requirements

Tevau is relatively friendly to KYC users in mainland China, and requires completion of Level 1 and Level 2 certifications, with specific requirements as follows:

- Level 1 Authentication: Photo ID is required (Chinese passport + foreign visa, tourist visa is not supported; or foreign driver's license, Taiwan users can use Taiwan driver's license).

Level 2 Authentication: After completing Level 1 Authentication, Biometric Authentication (Face Recognition) is required.- Note: It is necessary to ensure that the information is true and accurate, otherwise it will lead to application failure; the same user can only register an account, you need to use the original account login operation.

VII. Whether you need a cell phone number to register

The information on the existing webpage does not explicitly mention whether a cell phone number is required for registration, but only mentions that registration requires the creation of a personal profile, the completion of KYC authentication (providing identity documents and bio-verification), and the transfer of funds requires the filling in of the recipient's email address or invitation code. It is assumed that the registration may be based on the core identity of the mailbox, and the cell phone number is not a mandatory requirement, subject to the registration process of the platform.

VIII. Top-up method

Tevau uses USDT as the core recharge asset, and the recharge process is simple, as follows:

- Asset Preparation: Users are required to hold USDT digital assets.

- Wallet Funding: Transferring external USDT to the Tevau wallet via one of the platform's supported transfer channels, with no fees.

- Card top-up: Select the corresponding card in the “Cards” section of the platform, initiate the “Top-up” operation, transfer USDT from your wallet to the card, the system will automatically charge a fee at the rate of 1%, and USDT will be converted to the corresponding currency of the card in real time (USD/EUR) for consumption. USDT will be converted to the corresponding currency of the card (USD/EUR) in real time for consumption.

IX. Availability of physical cards

Tevau offers both a virtual card and a physical card, information about the physical card is below:

- Issue type: Visa physical card (USD currency), MasterCard physical card (EUR currency).

- Shipping method: by China Post EMS.

- Core Functions: Supports offline merchant card spending, global ATM cash withdrawal, can bind Apple Pay (only Visa physical card), Google Pay, and share the corresponding spending limit with the virtual card.

X. Characteristic highlights

- Compliance Guarantee: Holding US MSB + Hong Kong TCSP dual licenses, passing KYC certification, complying with global financial regulations, and adopting Fireblocks and other security technologies to guarantee the safety of users' funds and personal data.

- Seamless cross-scenario payment: Open up the cryptocurrency and traditional payment scenarios, USDT is instantly charged and ready to use, supports global Visa / MasterCard merchants to consume, ATM cash withdrawals, and binds the mainstream payment platforms (Alipay, WeChat, PayPal, etc.), solving the problem of offline use of USDT.

- Low Rates and Transparent Charges: Wallet reloading with zero commission, card reloading with only 1% rate, no annual fee and hidden charges, no commission on USD zone swipes, significant cost advantage.

- Flexible product system: support for multiple types of cards (4 types of cards are optional), virtual cards can be opened up to 5, physical cards can be opened up to 3, to meet the user's needs for multi-scenario, multi-account management.

- Value-added income function: idle funds can participate in the platform “earn” program, 7-day annualized yield of about 4.49%, support flexible subscription and redemption, income settlement by the hour, to achieve asset appreciation.

- Improvement of cooperation ecology: Provide API access, batch card issuance, co-branded card customization, invitation commission (up to 70%) and other functions for Web3 project parties, DAO organizations, KOLs and so on, and adapt to the scenarios of team payroll, incentive settlement, and content liquidation, and so on.

- Optimized user experience: smooth payment and settlement, no lagging problems; support for multi-terminal app operation, simple and easy-to-use interface, real-time checking of transaction records, and globalized service coverage to meet the needs of cross-border consumption, travel and other needs.