Link to open an account:https://app.vmcardio.com/#/login/register?code=112751

Recently, due to cross-border business needs, I experienced VMCardio virtual card platform in depth. As a practitioner who deals with overseas advertisement placement and subscription service every day, I am most concerned about theCard segment compatibility for payment scenariosrespond in singingConvenience of the account opening process. The following combines the actual use of feelings, share the real evaluation experience.

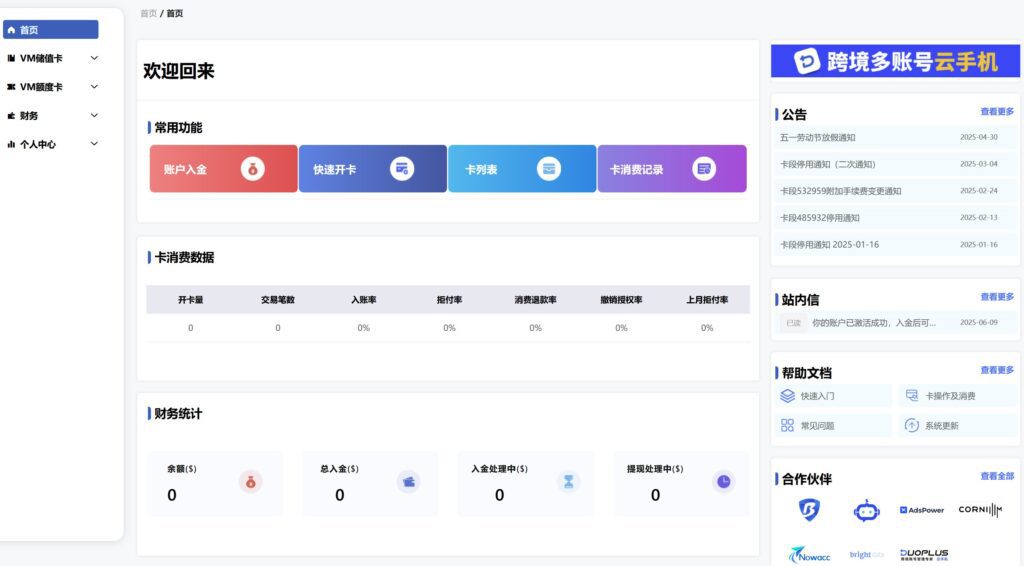

Account opening experience: zero KYC threshold, 10-minute high-speed registration

1. Minimal registration process, no real name required

- Registration: It supports the registration of domestic cell phone number or mainstream mailboxes, without the need for real-name information such as ID card, bank card, etc., which is very friendly to users who are sensitive to privacy protection.

- Invitation-based portalThe platform exclusive invitation link (such as https://app.vmcardio.com/#/login/register?code=42328) to register, the actual test click on the link to fill in the cell phone number / email, set the password can be completed, the whole process without manual review.

- Newbie Friendliness: The back-end interface is simple and clean, there is a guide prompt for the first login, and the core functions such as card opening and recharging are clear at a glance, so you don't even need to read the tutorial to operate it.

2. Flexible recharge options, mainly cryptocurrencies

- Supported CurrenciesThe main stablecoins are: USDT (TRC20/ERC20), USDC, DAI and others.

- speed of arrivalThe cryptocurrency recharge will arrive in a second, and we have tested that when you recharge USDT at 2am, the balance will be shown in the background immediately, which is suitable for urgent card opening needs.

- handling feeThe following are some of the most important features of the card: recharge fee of 1%-1.5%, card opening fee as low as 1.5 USD per card, no annual fee, no monthly fee, compared to similar platforms (e.g., the opening fee of a P-card is 5 USD), the cost performance is outstanding.

Payment Scenario Test: 30+ Card Segments Covering All Categories of Needs

1. Advertising: Facebook/TikTok/Google all-inclusive

- corecard segment::

- U.S. VISA Card BIN 441112(card opening fee of $1.5, recharge fee 1%): Tested for Facebook Ads card binding seconds, support for receiving 4-bit verification code (background "FB Verification Code" page shows in real time), advertisement deduction is stable, there is no refusal to pay the situation.

- Hong Kong MasterCard BIN 539502($1 card opening fee): Preferred when placing TikTok Ads, supports 3DS verification, up to $350 in a single transaction, and higher limits are available for consumption over 10,000 U per month.

- Advantageous featuresIn the background, you can input keywords such as "Facebook", "TikTok", etc. to display the number of recent successful payments for each card segment in real time, which will help you to rapidly Highly successful card segments (e.g. "Google Ads" will prioritize BIN 404038, with a measured success rate of over 90%).

2. Cross-border e-commerce and subscription services: from Amazon to ChatGPT

- E-commerce platform::

- Amazon/WalmartRecommended U.S. BIN 553437 (opening fee of $1.5), support for customized billing address, choose "U.S. address" when tying the card can be, the actual test to buy gift cards, physical goods are normal deduction.

- Shopify Independent / Aliexpress: Hong Kong BIN 418122 ($3 card issuance fee) has the best compatibility, supports multiple platforms such as Shopee Shrimp, Dunhuang, etc., and the rejection rate needs to be kept within 10%.

- subscription service::

- ChatGPT/Midjourney: U.S. BIN 491090 ($2 card opening fee, 2% fee) Pro-tested available, select "VISA Debit" when bundling Stripe payments, stable monthly subscription fee debit.

- Apple ID/Google Pay: Requires a U.S.-issued card segment (e.g., BIN 556167), supports adding to your wallet for direct payments, and makes purchasing apps or cloud services stress-free.

3. Special scenarios: air travel booking and corporate procurement

- Airfare / Hotel: US BIN 519075 ($1.50 card opening fee) works smoothly on Booking/Uber, supports dynamic CVV2 validation, some carriers (e.g. Delta) require manual entry of the billing zip code (you can generate a dummy address in the back office).

- Enterprise RequirementsThe platform provides "Shared Limit Card" function, after recharging to a unified pool of funds, you can batch generate daughter cards and set consumption limits (e.g., $5,000 per day for a single card), which is suitable for cross-border teams to manage their advertising budgets, and you can apply for customized rates and private card BINs when your monthly consumption exceeds 100,000 U.

III. Guide to avoiding the pit: these details need attention

- Card Segment ValidityMost of the card segments are valid for 1-3 years, and the background will remind you to renew the card 30 days before expiration, and the unused balance can be refunded to your account after the expiration date.

- repudiation risk: Some card segments (e.g. HK BIN 532959) are sensitive to the rejection rate, and the account may be frozen if it exceeds 5%. It is recommended to clear abnormal cards regularly.

- Customer Service ResponseAlthough it supports 7×24 hours online customer service, it is a little slow to reply during peak hours (such as during the daytime in the United States), and it is recommended that urgent questions be communicated in advance by e-mail.

IV. Summarizing: Who is it for?

- Recommended for::

- Cross-border e-commerce sellers (especially Shopify Indie, Amazon AdSense).

- Overseas Ad Optimizer (multi-account, multi-card segment management budget required).

- Tech enthusiasts (subscription to AI tools, overseas SaaS services).

- Not recommended for::

- Offline card or ATM cash withdrawal is required (online payment only).

- Strong dependence on fiat recharge (mainly supports cryptocurrencies, fiat channels need to be requested).

If you need aLow threshold, high compatibility, low costVMCardio is definitely the best virtual card tool on the market today. In particular, no KYC, unlimited card opening and spending scenarios query function, truly solve the pain points in cross-border payments. It is recommended that newcomers first test a small amount (such as charging $20 to open 2 cards), and then expand the scale of use after familiarizing with the process.