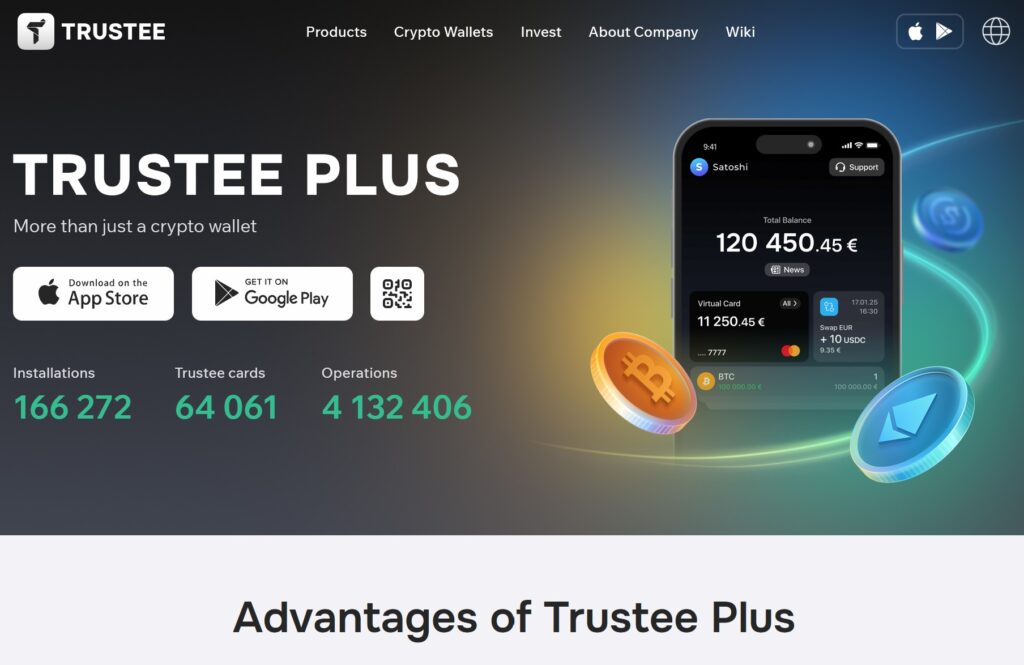

In recent years, as cryptocurrencies have gained popularity, more and more fintech platforms have tried to combine traditional payment tools with digital assets.Trustee(or Trustee Plus), a European virtual card platform, has attracted a large number of users due to its claim of "seamless cryptocurrency payments", but the compliance and security behind it has also sparked controversy. This article analyzes Trustee's business model, core features and potential risks, and provides objective advice for users.

iOS app URL:https://apps.apple.com/my/app/trustee-plus-wallet-card/id1634455978

Official website:https://trusteeglobal.eu

Purse:https://trusteewallet.org/

I. Trustee's Positioning and Core Functions

Trustee describes itself as a "comprehensive solution for crypto enthusiasts" that focuses on digital asset management, virtual card issuance, and cryptocurrency payments. Its core highlights include:

Virtual Cards and Cryptocurrency Payments

- Users can bind cryptocurrencies directly to virtual cards and spend them globally without having to convert them to fiat currency in advance. For example, Trustee Crypto Card supports mainstream coins such as Bitcoin and Ether, simplifying the daily use of cryptocurrencies.

Multi-currency wallet management

- Supports storage of multiple cryptocurrencies and NFTs, and provides decentralized exchange (DEX) functionality, allowing users to trade tokens directly from within the wallet.

user-friendly interface

- According to user feedback, its interface design is simple and suitable for novice operators, while providing advanced charting tools to assist trading decisions.

II. Advantages and Attractiveness of Trustee

The convenience of cryptocurrency payments

- Trustee allows users to spend directly in cryptocurrency, reducing transaction friction compared to traditional platforms that require fiat currency exchange.

Global coverage

- The virtual card can be used at merchants that accept Visa or Mastercard, covering a wide range of locations.

Innovative Technology Integration

- Security measures such as Hierarchical Deterministic Wallet (HD Wallet) and Two Factor Authentication (2FA) are used, with some features claiming to protect keys through TEE (Trusted Execution Environment).

III. Disputes and potential risks

Despite Trustee's attractive features, there are significant shortcomings in its compliance and security:

Lack of key financial licenses

- Trustee is not licensed as an EU Payment System License (PSD2) to directly manage interbank settlements or be regulated by a central bank and exists only as an e-wallet operator.

Weak financial protection mechanisms

- User funds are not covered by a deposit insurance system and users may not be able to recover their assets if the company goes bankrupt or is attacked.

Lack of transparency

- There are no public independent audit reports and financial stability is doubtful.

User complaint issues

- Some users reported transaction delays, slow customer service response, and even account funds being frozen by mistake.

IV. Comparison with compliant platforms

Users who place more importance on financial security and compliance may consider the following alternatives:

Revolut

- Holds Lithuanian EMI and banking licenses, is regulated by the Central Bank and supports mixed cryptocurrency and fiat accounts.

Wise (formerly TransferWise)

- Offers low-cost cross-border transfers, works directly with banks and is PSD2 compliant.

PayPal

- EU e-money licensee with integrated cryptocurrency buying and selling functionality, subject to conversion to fiat currency for use.

V. Legal and security recommendations

Critical assessment of needs

- If high-frequency cryptocurrency payments are required, Trustee's convenience has some advantages; however, if large sums of money are involved, it is recommended to choose a licensed platform.

Enhanced account security

- Enable 2FA, back up your helpers regularly, and avoid logging into your wallet on public devices.

Focus on regulatory developments

- The EU is tightening regulation of crypto assets (e.g. MiCA Act), which could affect the operating model of platforms such as Trustee in the future.

VI. Future prospects

Trustee needs to address the following issues if it wishes to grow in the long term:

Apply for a financial license, to enhance compliance;

Introduction of independent auditsand enhance transparency;

Optimize customer service system, improving the user experience.

concluding remarks

Trustee provides innovative ideas for cryptocurrency payments, but its "gray zone" mode of operation may become a double-edged sword. While enjoying the convenience, users need to weigh the risks and diversify their assets. For users who prioritize security, a licensed traditional fintech platform is still a safer choice.